When I decided to make a full-time career out of Real Estate in 2007, I entered an industry that everyone was leaving. It was like going the wrong direction on the freeway. I remember the judgmental reactions I’d receive whenever I told someone I left my stable Engineering career in order to try my luck in Real Estate. Some would bluntly ask, “Are you crazy? There are NO houses selling!”

While others saw chaos and uncertainty in declining home prices, I saw opportunity in distressed homes. I remember meeting a savvy investor who had a motto, “I can make money in ANY market: up, down, or sideways.”

Like almost all agents, I started working with buyers. I sincerely felt that the massive supply of distressed homes would present a once in a lifetime opportunity to buy a home with historic affordability.

It didn’t take long for my frustration to kick in. I found out that most buyers are either unwilling or unable to buy at the bottom of the market. It wasn’t until my 3rd year in Real Estate did I learn to qualify a buyer for motivation.

Although I improved my buyer representation skills, I was still puzzled. Why do most buyers including “move-up” buyers wait until prices go up?

In order to answer this question, I have to identify (3) factors:

The buyer’s personal “market” – This is the buyer’s personal finances. I remember sitting down with a past client that shared his frustration: “We had everything in order to buy a larger home when the prices dropped. Then my mother contracted cancer and our expenses skyrocketed.”

Unfortunately, this cycle seems to sync with the Real Estate market for most. The Real Estate market is often tied directly to the economy, so while prices may be low, buyers often face salary reductions, layoffs, and overall uncertainty. The uncertainty often results in the conservative individuals to increase their savings even when their income is not in true jeopardy.

The buyer’s emotions – For the buyer who’s looking to purchase a home to live in, this is often the most important factor: How they feel. Just like the first factor, this seems to be in sync with the Real Estate market for a number of reasons.

Friends and Family:During the bottom of the market, buyers are often ridiculed by their friends and relatives who believe the market will only go down further. There are more escrow cancellations during this time of the market due to a higher rate of buyer’s remorse.

Local and National Media: keep in mind that all metrics reported in Real Estate by the media are trailing indicators, or reporting on what happened in the past. Additionally, it’s no secret the “doom and gloom” headline is more likely to create a buzz and go viral when compared to a positive headline. During the bottom of the market, headlines read similar to this: “Orange County Median Prices Drops by 20% — the 3rd Consecutive Year of Decline.” My most memorable one was a front page photo of a family being evicted from their foreclosed home. The attention-grabbing image showed the the family sitting on the curb with all of their heads looking at the ground.

Lack of scarcity: Humans need scarcity in order to place value on something. We like to pursue things that seem out of reach. During the bottom of a Real Estate market, supply is high and it’s often perceived the selection will last forever.

Too much emphasis on how much their current home is worth: for the “move-up” buyer, they rarely look at the more important side of a move-up transaction: the purchase. In 2004-06, many move-up buyers bragged to me how much they sold their home for only to buy a larger home at an inflated price. Many do not realize the the gap widens between their current home and the larger home once prices increase.

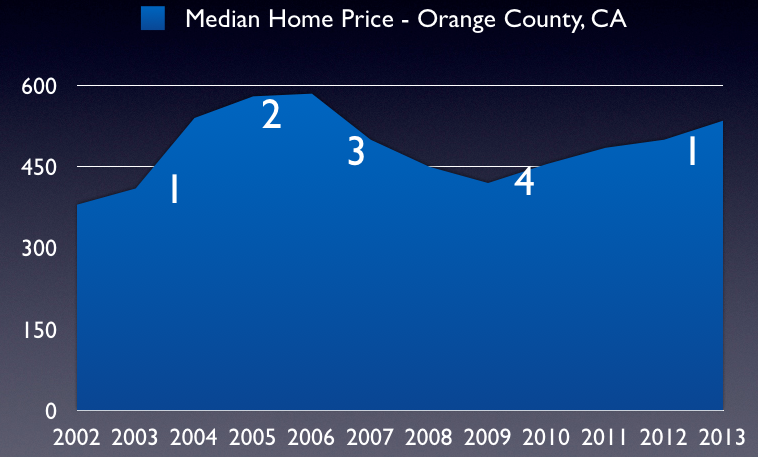

The local Real Estate market – The Real Estate cycles are often very predictable. Prices go up, then they go down.

Like most, I once thought that this was the most important factor. I would arrogantly think to myself, “Are most people stupid? Why do they want to do the opposite of what you should do?”

Here’s the reality: the external market takes a backseat to an individual’s internal market mentioned above. As Suze Orman once said, “The best time to buy is when you’re ready.”

So, does this mean that you should just react to the Real Estate market like the masses? Of course not. The solution lies in what Warren Buffet said, “Be fearful when others are greedy. By greedy when others are fearful.” In other words, do the opposite of what seems instinctive. If you receive more income, cut your expenses. When things seem unstable, invest in something.