Before we get into what Mello Roos is, let’s look at some of the amounts published by builders in Blackstone and La Floresta in Brea:

Emerald Heights by Shea Homes: $976.43 for Plan 2 & 3; $1,226.43 for Plan 4

Coral Ridge by Shea Homes: $1,226 for Plan 1 & 2; $1,412.76 for plan 3

Paseo by Standard Pacific Homes: Amount not published. The brochure states “approximately 1.13%.” I estimate the amount to be about $728 when working backwards form the sales prices and likely will be higher or lower depending on floor plan purchased.

Ventanas by Van Daele: Approximately $800 depending on homesite

Avenida by Standard Pacific Homes: $800 per year depending on homesite

What exactly is Mello Roos?

The term itself comes from The Community Facilities Act of in 1982 authored by Senator Henry J. Mello and Assemblyman Mike Roos. The Act created “CFDs”, or Community Facilities Districts which are established by local government agencies to raise community funding.

In other words, it’s a way for a builder to finance the infrastructure needed to create a new development. This is commonly done through selling bonds. The duration of the Mello Roos depends on the life of the bond. In some areas of Placentia near Champions Sports Complex, the bonds were for 15 years.

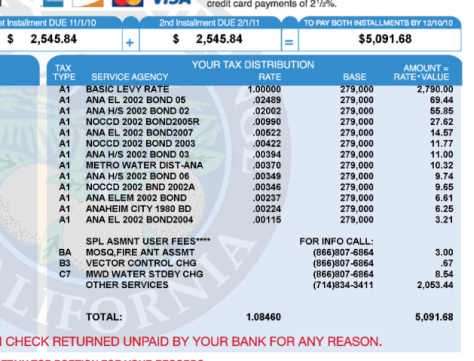

From the tax bill above, you’ll see the “basic levy rate” of 1%. In California, this is the base tax rate for a property. North Orange County cities are typically about 1.03% to about $1.15% in communities that “don’t have Mello-Roos.” In Real Estate lingo, while it’s not technically correct, having Mello Roos is any amount significantly above that range. In the bill above, you can see that CFD’s are inline with normal bonds.

However, there’s a line item only described as “other services” for an additional $2053.44! This amount is not technically “Mello Roos” per the definition above.

Confused?

That was intentional. Don’t worry — you don’t have to be an expert on Mello Roos when buying a home. (However, your Real Estate agent and CPA should know the difference.) What’s important is to know is if the total tax exceeds the normal rate in the area. Once it does, sales data shows it will affect the sales price of a home. Since it boils down to monthly payment for most buyers, the effect is similar to HOA dues.

So, next time you want to irritate your friends on the subject or Real Estate and someone asks, “How much is the Mello Roos in that community?” You should answer, “The question you should be asking is: How much are the additional bonds and assessments above the base tax rate?“

wh0cd134889 buy antabuse

I’m nnot sure where you are getting your info, but great topic.

I needs too spend some time learning much more orr understanding more.

Thanks for great info I wass looking for

this information for my mission.