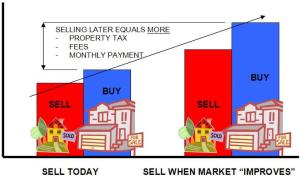

If you’re a fortunate homeowner who has equity in this market, you might be considering whether you should upgrade now or wait until prices get better so you can sell your house for more.

[youtube http://www.youtube.com/watch?v=c0hBMi58zCA?rel=0&w=480&h=360]

First, we need to determine which transaction you are most concerned about: Selling or buying? Are you concerned that your house will not sell? Or are you concerned that you won’t find a home that suits your needs?

You have to keep in mind that if you’re selling in order to buy, you’re trading equity. In most cases, the gap between the sale of your home and your purchase will move up and down with the market.

When selling in order to buy low:

- Your property taxes will be lower

- Monthly payments will be lower

- More selection (purchasing in a buyer’s market)

When selling high and buying high:

- buying in a “seller’s market” – possibly at peak

- higher property taxes

- less selection – more “move-up” buyers to compete with

- Higher closing costs

With these factors in mind, most would agree that buying low and selling low is a homeowner’s best option.

Here are the (3) most common options that homewoners have for moving:

- Move Twice

- Leaseback / Rentback

- Sell Contingent

When you move twice, you sell your house without any contingencies and move into temporary housing (apartment, rental, stay with relatives, etc) while looking for a replacement property without the stress of a deadline. Since there aren’t any restrictions with the sale of your home, all buyers are eligible, giving you the best chance of selling at the highest price. When it’s time to purchase, you will be buying “non contingent,” making you eligible to purchase any listing: equity sales, bank owned, or short sale. This would give you the best chance of purchasing as low as possible. You get the best of both worlds.

Leaseback / Rent back

When you sell with rent back, it saves you the hassle of finding temporary housing at the expense of possibly limiting the sale of your home. With this option, you sell and buy “non contingent”, and your buyer leases the property back to you for a period of time (typicall 1 month). This option limits your buyer pool because some buyers may not like the terms of a leaseback and/or would like to move into their home as soon as possible.

Sell Contingent

When selling and/or buying contingent, you enter a contract that is dependent on you finding and buying a replacement property. With this option, the sale of your home cannot be completed until you find a replacement property and you remove your contingency. In essence, the buyer of your home cannot complete their purchase until you give them permission. This may have an impact on your sale price and creates other complexities: When will the buyer conduct their inspection and appraisal? Will you refund any costs to the buyer if you cancel the contract? Furthermore, if you decide to buy “contingent upon sale” of your home, it will eliminate most listing types that you can offer on. Bank Owned homes will not accept a contingent offer.

Tax deferred exchanges (1031) will be covered in an upcoming blog. For an estimate on your home’s value and how this can apply to your situation, call Edwin at 714-501-2732.

adultdating.us.com

wh0cd177307 tadalafil canada