In a prior blog, I explained that if you’re a homeowner waiting for home values to increase, it will actually cost you more money. Especially in the example where a homeowner is looking to “move up” into a larger home, the gap can widen significantly between your home and your replacement home. Additionally, loan costs, commissions, and property taxes will be higher.

Of course, the ultra-conservative, zero risk-type of person will always find a reason to stay put and never sell. It’s a miracle they aren’t a lifetime renter. For the others who want to upgrade their quality of life, don’t worry — you still have plenty of options.

[youtube http://www.youtube.com/watch?v=c0hBMi58zCA&w=420&h=315]

For the homeowner who wants to transition immediately into their replacement residence, they can choose from the following:

- Buy & Sell “non contingent” – in most cases, the homeowner will first place their home on the market and close escrow in order to use the proceeds for their upleg home. The best terms and price are possible because you aren’t placing any restrictions on your sale or your purchase. This will require moving twice: once into a temporary residence until you find your replacement home then moving again once you close escrow on your purchase. The limbo period with this option will be the longest, but you don’t have the worry of having a deadline to purchase.

- Sell with a rentback – in this option, you’d sell to a buyer who’s willing to let you rent from them until you close escrow on your replacement home. The lease period is usually capped at 30 days due to lending standards (unless you find a cash buyer). As you can imagine, it can become quite stressful if you can’t find a replacement home when your home is in escrow. Once your home is under contract, you can’t back out unless the buyer allows it.

- Sell contingent upon your purchase – especially for the homeowner that’s concerned most about not finding a suitable replacement home, you can place restrictions on your sale. In this option, you’d place your home on the market and sell to a buyer that’s willing to cooperate with your transition. This will likely cost you money as it usually will eliminate the most motivated buyers. If you can’t find a replacement home, you can cancel with your contingency.

For the homeowner who doesn’t need to sell in order to buy, they have the option of completing their purchase then having the option to make their existing home a rental property or sell at a later time. It’s very important that you know upfront what commitment you’re making.

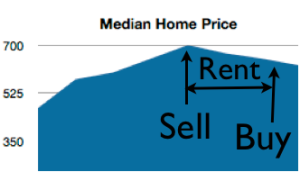

For you risk-takers, I have a fourth sexier option: Time the market. You would do something everyone advises against: predict when home prices have peaked and cash out your equity by selling. Then, you watch on the sidelines (while renting) until you feel selection has improved or prices have fallen enough. In most cases, the proceeds would be protected against capital gains due to primary homeowner exemptions.

This will require a thorough understanding of the market. Don’t rely on what the public and media thinks — they’re always telling you to do the opposite anyway (i.e. – they said 2005 was a good time to buy and 2008 was a “bad” market). Look at the following indicators:

- Supply & demand: “Months of supply” – a metric that uses prior demand into today’s supply number. In Southern California, 4-5 months of inventory is classified as a “par” market. Anything higher is a buyer’s market and lower than 4 months is seller’s market. A Realtor should know this number in their local market.

- % of distressed inventory – even when supply will indicate a seller’s or buyer’s market, it shouldn’t be used alone to determine if prices will rise or drop. Since maximum price isn’t the main priority of a distressed property, having over 40% of short sales and REOs can wreak havoc on values due to condition, lender’s lack of attention, and higher fraud rate over traditional equity sales. Two good sources of data are ForeclosureRadar.com and RealtyTrac.com.

- Government intervention and lawsuits – recent tinkering of the market through foreclosure moratoriums, first time homebuyer incentives, and large-scale settlements are some of the recent ways the home supply was either severely limited or demand was increased.

Even with this knowledge, you must know that you will be off with your prediction. A realistic goal is to be within 12 months of the peak.

I’ve met a small handful of homeowners who were able to pull off this feat. One of them was an Engineer named John who thought 2005 was the best time to cash out his equity and it turned out to be a good decision. He rented for 2 years and re-entered the market in early 2008 as foreclosures and inventory levels were rising. While his timing on the purchase side was off by a few years, the difference in saving compared to if he simply “traded equity” in 2005 was over $150,000. Additionally, he had absolute control of terms and selection when placing offers.

As you can imagine, if you sell at the wrong time while prices continue to rise, you can become a renter indefinitely. This isn’t the end of the world. At some point, when affordability becomes unattainable to the public, the advantages to home ownership can be reduced significantly due to a widened gap between would-be mortgage payments and rent payments.

Thanks for the terrific manual

I like the article