Through an agent’s perspective, I get told countless times, “We plan on renting only one year, then we plan on buying after _____.”

That ____ is usually:

1. we save more money for a down payment.

2. we raise our credit score / “fix” our credit.

3. things become more stable at work.

Those seem to be the most common and I have to assume I’m being told the truth. Speaking of the truth, many are simply ashamed to say the REAL reason: they aren’t ready — for whatever reason. As most Real Estate gurus would say, the best time to buy is when you’re ready.

Let’s say you think you’ll be ready in 1 year. That gives you 12 months to get things in order. While it may seem like a lot of time, most procrastinate and start looking at homes when they still don’t have an optimal situation to get the best interest rate and a home that suits their needs. Keep in mind that it will likely remain a seller’s market in the Orange and LA County Real Estate markets around this time next year and your offer will need to stand out in a multiple offer situation.

Let’s look at some of the things that can weaken an offer outside of price:

1. Asking for closing costs – there are some sellers who don’t know how closing costs affect their bottom line. Additionally, when asking for closing costs, you are in essence financing them and adding them to the price. This sometimes can force your offer to go above what it can appraise for. An experienced listing agent can anticipate this and advise the seller to go with another offer.

2. FHA financing – although many experienced loan officers can easily do these loans in under 30 days, they’re often given a bad rap. Additionally, FHA loans can be troublesome in some condominium complexes and homes that are “fixer uppers.” While a good Real Estate Agent and loan officer can have strategies to avoid issues, all that matters during negotiation is the perception of the seller.

3. Low credit scores – some listings will require credit reports to be submitted with offers. There can be an instance where another buyer wins out simply because their FICO score was higher.

4. Hiring amateur representation – as a Real Estate agent who works on the listing side about 70% of the time, I can remember several instances where the buyer’s agent didn’t know how to properly write a contract with the correct forms. I warned the seller against their offer because it was a sign of what trouble could be lurking when in escrow. Despite the saying, “everything is negotiable,” there are certain unwritten rules that are expected during negotiations — regardless if it’s a seller’s or buyer’s market. On the financing side, having a pre-approval letter from some no-name lender that won’t return phone calls have been deal breakers as well.

5. Offering (or selling) contingent – placing an offer “contingent upon” the sale of your own home is often the kiss of death. Why would a seller that has multiple offers accept a contingent offer unless you’re willing to pay significantly more? If you plan on selling before you buy, having the sale “contingent on purchase of replacement property” can limit your buyer pool.

Putting Your Best Foot Forward

You can avoid the stigma of all (5) weaknesses above with some proper planning. A sound plan can result in a better interest rate and/or a better home for years to come. While most of the following advise is common sense, you’ll be surprised how many don’t act early enough.

1. Start getting familiar with home prices now. Most expect values to be slightly higher next year, so a good bet would be to add 5% to home prices you’re seeing right now and see if you’d be satisfied with what you think you could buy. Use mortgage calculators to get familiar with monthly payments compared to what you’re paying right now in rent or a mortgage that you already have. There’s a mortgage calculator available on: www.OCgoldmine.com

2. Save money. Yes…duh! 20% would be ideal to avoid mortgage insurance and some of the tighter requirements that come along with the lower downpayment loans. If you realize this isn’t possible, aim for at least 6%. That would allow you to have 3.5% toward the downpayment on a 96.5% FHA loan and the remaining funds could be used toward paying closing costs.

3. Lower your debt. During the market frenzy of 2003 – 2006, it was all about credit score. Now, credit score has taken a back seat to “debt-to-income” ratios, the amount of debt payments vs. your gross income. You can lower your monthly debt by reducing your credit balances. While it will be good to reduce your balances on your credit cards, this does not mean you should close any accounts — this will hurt your score. Paying off loans might help, too. However, before paying off any loans or “big ticket” items such as a car or boat, get input from a loan officer to see if that cash would be better applied toward your downpayment.

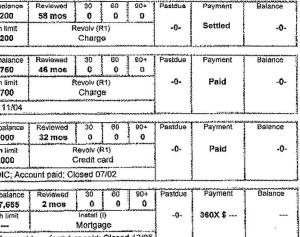

4. Review your credit report. Two areas of your credit report are crucial: Credit Utilization and Payment History. Credit utilization is the ratio of how much total credit has been granted vs. how much is used. As mentioned above, the lower amount used will be better for your debt-to-income ratio. In the later pages of your report, you’ll see your payment history. If you see any discrepancies, call your creditors and have them fixed as soon as possible. It will take some time for the corrections to show on your credit. If you have late payments or accounts charged off, you’ll want to counter that stigma by having consecutive months of on-time payments.

5. Have a lender review your financials NOW. Again, many feel too embarrassed to have a lender review their financials: income, bank statements, tax returns, and credit. Conducting an early review will help you shore up any weaknesses.

6. Meet with a Real Estate Agent. Unfortunately, most will not complete this step until they start looking at homes. This crucial step is undervalued because many feel that an agent simply opens lockboxes and doors — which couldn’t be farther from the truth. A good agent can give you some valuable insights on how to plan accordingly, what to expect, and common mistakes to avoid. Be honest and direct — an agent with a healthy workload won’t try to “sell you” on something you’re not ready to do. Furthermore, if you feel any pressure from them, tell them you don’t qualify for a loan yet (from step #5). Since a short sale listing can take months to complete, this meeting should be done at least 6 months before your target date.

If you’re considering selling your existing home in order to buy, the agent would be able to estimate proceeds that could be used toward your downpayment and give you an idea how long it would take to sell. You can also review your transition options: a) Moving twice, b) Selling with a leaseback, c) Selling and/or buying contingent.