If you’ve found this blog just by searching on the internet, there’s a good chance you’ve read the advantages a Short Sale can have over simply “walking” from the property and letting your lender foreclose.

In case you haven’t heard the reasons, let’s list some of them:

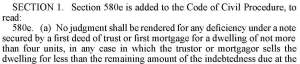

1. No Deficiency – if you have a “recourse” loan in California, you can be subject to further collections and a deficiency judgment after foreclosure. On the other hand, California Civil Code 580e prohibits lenders of 1st and junior mortgages from seeking the shortage after completion of a short sale.

1. No Deficiency – if you have a “recourse” loan in California, you can be subject to further collections and a deficiency judgment after foreclosure. On the other hand, California Civil Code 580e prohibits lenders of 1st and junior mortgages from seeking the shortage after completion of a short sale.

2. Less credit impact – while it’s true that in many cases a Short Sale is treated equally as foreclosure in loan applications, keep in mind that a human (as opposed to a computer) will view a person’s attempt to settle a debt vs. simply walking from it reflects better character.

3. Less Stress / Guilt – most homeowners that are facing foreclosure say that their biggest source of stress is uncertainty. The thought of a sheriff eviction or their home being listed as a “Bank Owned” home shatters confidence. In a short sale, the sale of the home at least adds some certainty and timeline when to move on the homeowner’s terms as opposed to the bank’s.

3. Less Stress / Guilt – most homeowners that are facing foreclosure say that their biggest source of stress is uncertainty. The thought of a sheriff eviction or their home being listed as a “Bank Owned” home shatters confidence. In a short sale, the sale of the home at least adds some certainty and timeline when to move on the homeowner’s terms as opposed to the bank’s.

We’ll cover the biggest advantage of a Short Sale over Foreclosure in a minute.

In most cases, at least 2 of those 3 reasons are worth taking the time to hire a Short Sale Specialist and cooperating with showings of your home.

On the other hand, when does Foreclosure become the better option over a Short Sale?

1. When you have a non-recourse loan and your lender is requiring a significant cash contribution or promissory note. This is on a case-by-case basis and everyone’s situation will be different. You’ll need to put a dollar amount on how much the credit damage will cost you in terms of higher interest rates on credit and your ability to re-enter the Real Estate market while prices are low. If the lender’s amount exceeds this amount you estimated, then it’s not worth it. Of course, you’ll want an attorney to review your loan to see if it’s truly a non-recourse situation.

2. Short Sale becomes Counterproductive – The biggest advantage to seeking a short sale is maintaining the mindset of person who wants to move on from this “transitional” period in their life. Staying in “limbo” adds to a homeowner’s stress and doesn’t focus on recovery. However, when a short sale negotiation doesn’t go right, it can conflict this goal of recovery. Even after you hire a Short Sale Specialist Realtor to reduce your workload, there’s still time and decision making required on your side. If you have a foreclosure auction scheduled and the lender is unwilling to mutually postpone, attorney and court fees can pile up. When certain lenders or their investors get too difficult to deal with, it may be better to cut your losses and just let the lender foreclose after giving the short sale settlement a “reasonable” attempt.

Of course, you can offset some of the possible frustration with a sound gameplan. A seasoned Short Sale Specialist will know which scenarios are usually toughest to deal with: Mortgage Insurance (also known as “MI”), non-delegated servicing agreements, investors who usually don’t cooperate with short sales, homes with auction notices, notoriously difficult 2nd lenders (Chase, Greentree, Cal HFA, Bank of America, etc). You can be pre-emptive in determining possible payoffs, cash contributions from other parties, etc.

3. The home is vacant and the cost of maintenance will be too high. A vacant home is a liability. If your home has significant costs outside of the mortgage (Homeowner’s Association Dues, utilities, insurance, upkeep of the pool, grass, etc) you have to compare which option will be faster. Put a dollar amount on these costs and see if it outweighs your estimate of how much credit damage a foreclosure will cost you. Regardless of which option you choose, a home gathering code violations from the city and delinquent HOA dues can come back to haunt you even after the sale is completed. Again, a good Short Sale Realtor will have other options including having your lender subtract the balance from the payoff amount or settling the costs.

4. Lienholders who won’t cooperate – These are usual private individuals (people you know) who have placed a lien on your home. Yes, there’s a motto that “everyone has a price,” but my experience tells me that disgruntled parties may want only to make your life miserable. I’ve had ex-spouses of some of my clients demand full payoff or “substitute collateral.” I’ve had contractors who placed contractor liens and simply laughed when they were approached on a settlement. Again, a short sale is only worth so much money and your dignity.

Again, none of those above scenarios are no-brainers. At the very least, you’ll want an experienced Short Sale Realtor to review your situation. Be careful — there’s always someone desperate to take any listing to simply get a sign in your yard. A good agent actually turns down a good portion of short sales for the benefit of both parties.

Edwin Baloloy is a Short Sale Realtor that services North Orange County (Anaheim, Anaheim Hills, Brea, Cypress, Fullerton, Yorba Linda, and surrounding areas) and is available for an in-office consultation for no fee. He can be reached at 714-501-2732.