When I reached out to my mortgage servicer to make a payment earlier this year, I heard the usual script from the representative on the phone:

“Has any of your contact information changed?” NO.

“Are you on active military duty and need assistance?” NO.

“I see that your address in in a FEMA disaster area. Would you like to hear more about mortgage assistance?”

Stop right there. What does that mean?

At first, I thought it only applied to homeowners who had their homes burned to the ground or damaged to the fires. NOPE — it also applies to homeowners who’s income was affected.

Just to be clear, FEMA does NOT give direct assistance to homeowners. The assistance and programs are done through Fannie Mae and Freddie Mac (Government sponsored enterprises who provide a secondary market by purchasing mortgages). I currently don’t know if FHA loans are eligible. More on that later.

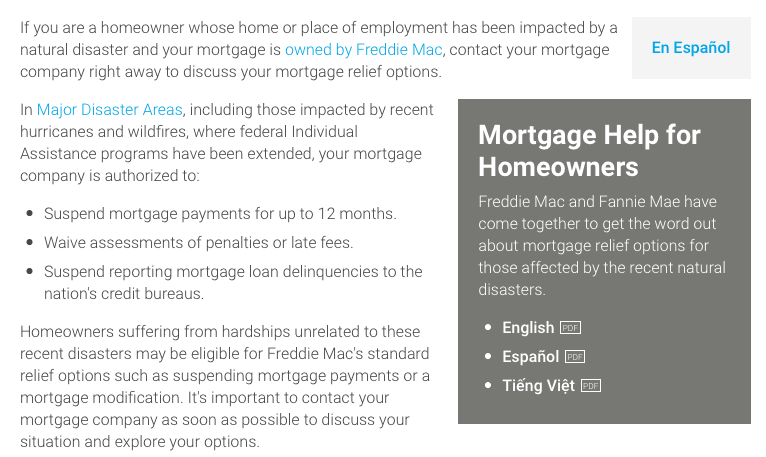

Here’s the details on assistance from Freddie Mac’s website:

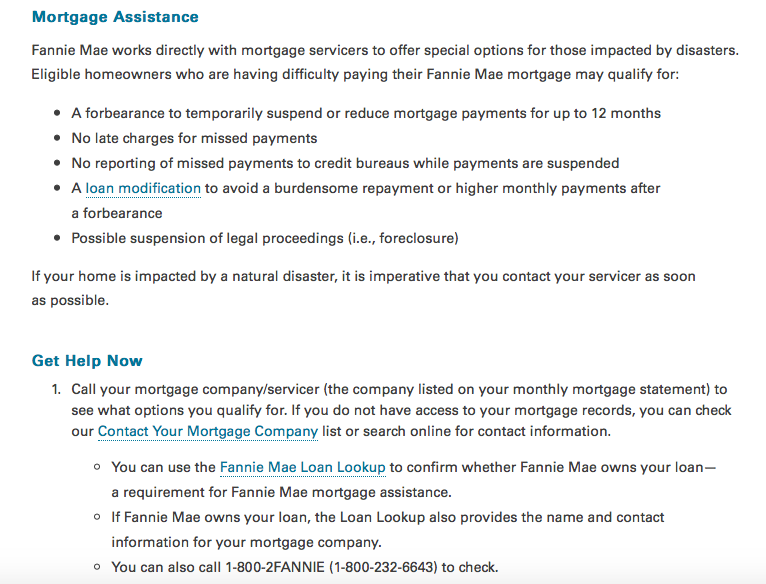

Here’s the screenshot from Fannie Mae’s KnowYourOptions website:

How do I know if I have a Freddie Mac or Fannie Mae loan?

You can use the Freddie Mac or Fannie Mae lookup tools. Or — you can contact your lender.

What if I don’t have a Freddie Mac or Fannie Mae loan?

Contact your lender regardless. However, if you can make a payment, continue to do so as it can affect your credit and/or change your loan status and face possible foreclosure.

For FHA loans, they were a bit on the vague side on the HUD website.

DISCLAIMER: Never assume that you’re eligible for assistance. Make sure you check with your lender. Missing payments can have many consequences including negative credit reporting and/or foreclosure proceedings.

wh0cd177307 pyridium over the counter

wh0cd1940363 buy erythromycin