Out of the following factors, which did NOT contribute to more homes for sale?

A. Rising interest rates

B. Sellers “testing” the market

C. Market momentum leading to more “move up” sellers listing their homes for sale

D. Banks finally releasing foreclosures

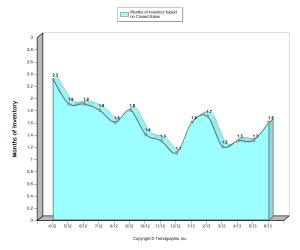

In a prior blog, I “boldly” predicted that June’s numbers would show inventory rising for the 3rd consecutive month and would continue rising until we reached 2.5-3 months of supply.

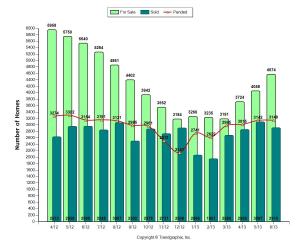

Expect July’s numbers to report the 4th consecutive month of rising inventory from higher interest rates, sellers “testing” the market, and market momentum leading to “move up” sellers to place their home on the market after seeing the value of their existing home increase.

NOT a factor: Distressed Properties / Bank-Owned Homes. The correct answer is D.

According the the monthly lender-mediated report released by Pacific West Association of Realtors, “lender mediated” sales made up only 16.6% of sales for June. While it’s true that lenders will be releasing more homes on the market through bulk sales to smaller investors and through GSE investors such as Fannie Mae and HUD, the impact it will have in Orange County will be minimal.

Unfortunately, the slight uptick in supply hasn’t resulted in more selection for the buyer who has faced nothing but frustration from losing bidding wars. While inventory might be up, “months of supply” is still at an extremely-low 1.6 months.

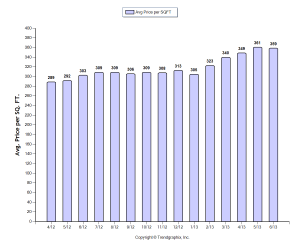

As summer winds down, the homebuyer that isn’t at the peak of their qualifying price can start becoming optimistic about selection as interest rates start reducing affordability. I don’t expect prices to be affected until we reach 3+ months of supply. Until then, expect prices to remain stable.