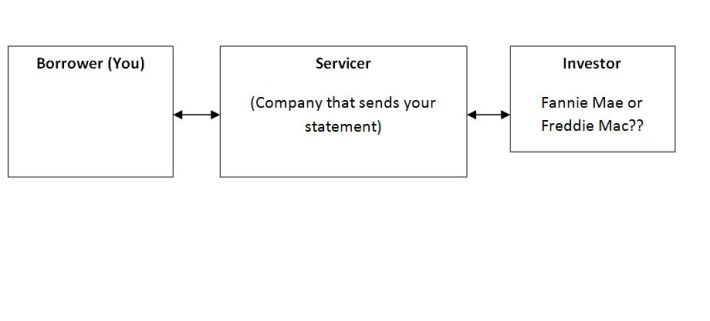

The 2 largest investors in our nation have added another program for homeowners who have continued to make payments on their mortgage while their home is upside down. Fannie Mae and Freddie Mac are two of the “GSE” investors that own many mortgages while large servicers such as Bank of America, Chase, Ally, CitiMortgage, etc, collect payments for them.

Is your loan owned by Fannie Mae or Freddie Mac?

You can check if your loan is owned by either of them by following these links:

Fannie Mae: https://www.knowyouroptions.com/loanlookup

Freddie Mac: https://ww3.freddiemac.com/corporate/

Make sure you enter your information EXACTLY the way it is written on your mortgage statement from your 1st mortgage. Fannie Mae & Freddie Mac usually do not own any 2nd mortgages or HELOC loans.

Let’s summarize Fannie & Freddie’s reactions & solutions to the housing crisis over the past years:

1. HARP / HARP 2.0 – a refinance program for homeowners that have been current on their payments. Loan-to-value can be over 100%.

2. Fannie Mae quietly tells servicers not to postpone auctions if the borrower is more than 12 months delinquent.

3. Although the $27B settlement includes generous principal reductions, Fannie Mae and Freddie Mac initially did not participate. They later change their tune after political pressure and allow limited principal reductions under certain circumstances.

4. Fannie Mae and Freddie Mac withdraw from HAFA in December 2012. HAFA is a short sale program that included a $3,000 incentive to the borrower and full forgiveness of the debt.

5. The National Association of Realtors urges FHFA to revaluate the valuation issues reported by agents from Fannie/Freddie short sale properties. Several Realtors across the country suspect that Fannie/Freddie are intentionally inflating values to derail short negotiations. Failed short sales usually lead to foreclosure.

6. Fannie/Freddie announce that they no longer require borrowers to be delinquent on their mortgage to qualify for a short sale.

7. Here’s the latest: Fannie Mae announces a new deed-in-lieu program that allows homeowners who are current on their mortgage to walk away with full forgiveness.

Anyone notice some consistency here?

Fannie/Freddie have voiced their concern with programs that seem to be encouraging homeowners to miss payments on their mortgage. While it may sound good on the surface for the housing market, some of the policies have punished homeowners who were simply seeking a foreclosure alternative.