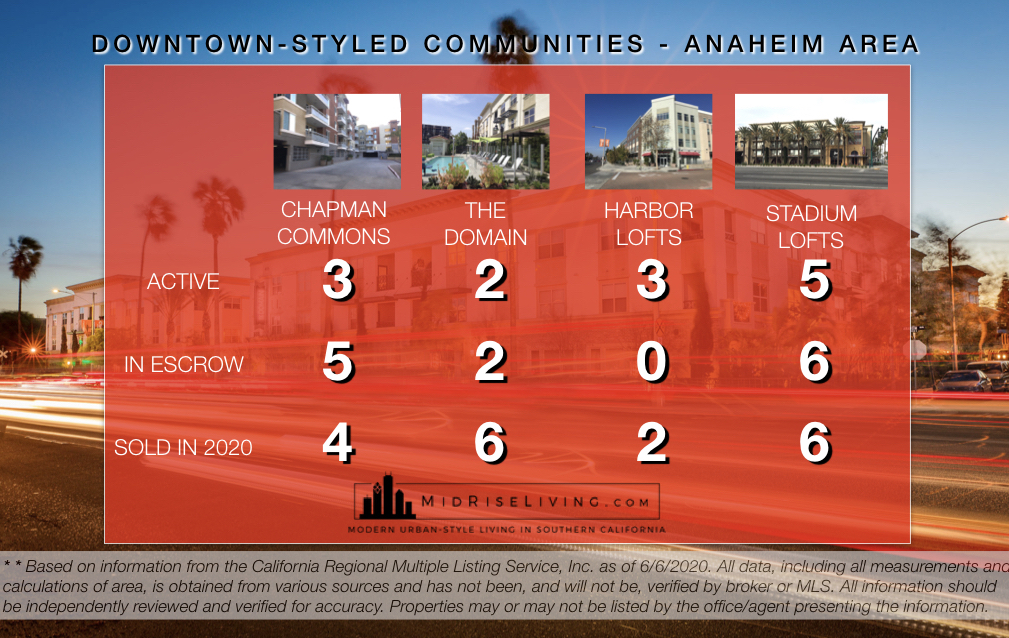

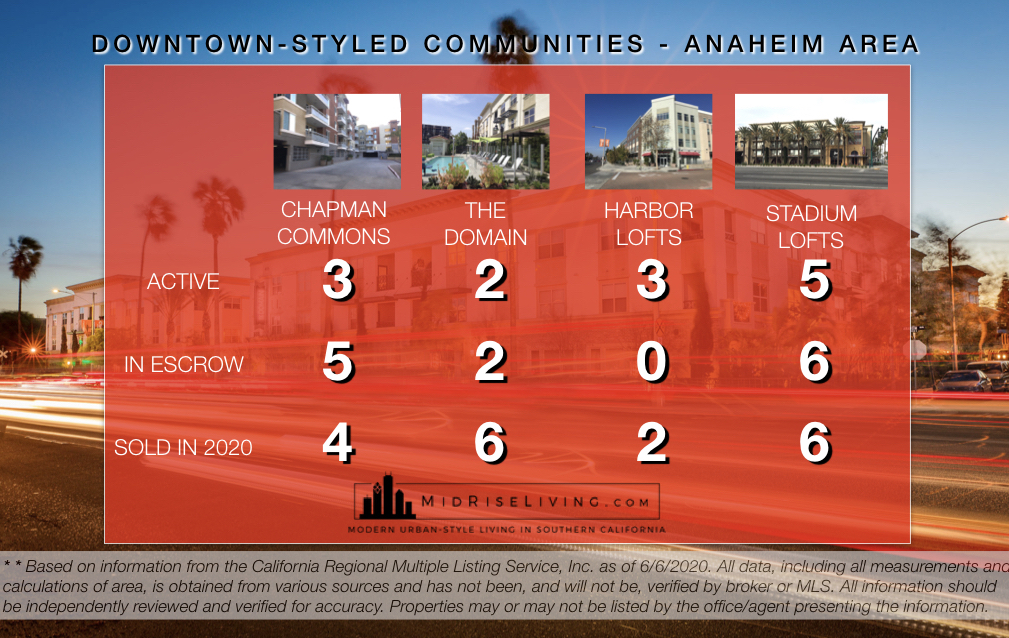

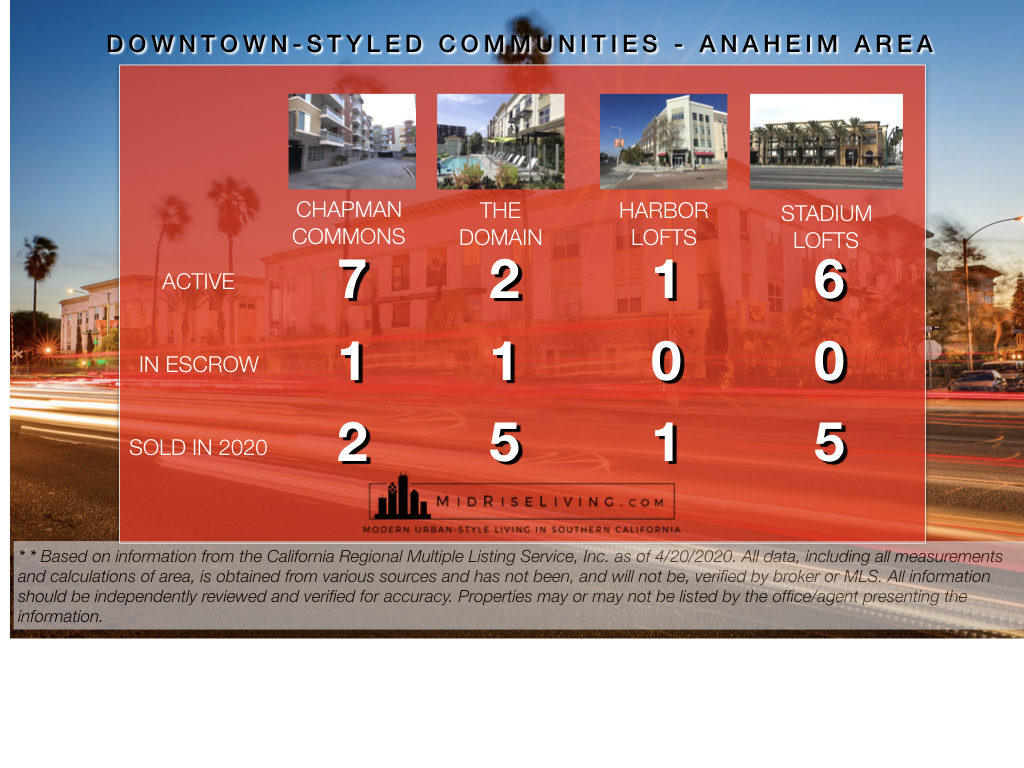

Active listings in Chapman Commons, Harbor Lofts, The Domain, and Stadium Lofts:

Sorry we are experiencing system issues. Please try again.

Lifestyle Residences for modern living.

Active listings in Chapman Commons, Harbor Lofts, The Domain, and Stadium Lofts:

For those who own investment properties within Chapman Commons, The Domain, Harbor Lofts, and Stadium Lofts within the Anaheim Platinum Triangle and Anaheim Downtown Area, you’ll need to be aware of the entire rental market outside of your building. Many prospective tenants will cross-shop your building with nearby new luxury apartment buildings that offer generous amenities.

Published prices from websites on 5/4/2020:

Jefferson Platinum Triangle – 1 BD/ 1 BA, 724 SQ FT – $2,100; 2 BD / 2 BA, 1,062 SQ FT – $2,242; 2 BD + DEN / 2 BA, 1,275 SQ FT – $2,789

1818 Platinum Triangle – 1 BD / 1 BA, 890 SQ FT – $1,947

Parallel – 1 BD / 1 BA, 735 SQ FT – $1,975

Core – Studio 1 BA, 604 SQ FT – $1,914; 1 BD / 1 BA, 728 SQ FT – $2,216; 2 BD / 2 BA, 1,081 SQ FT – $2,622

Stadium House – 1 BD / 2 BA, 991 SQ FT – $2,308; 2 BD / 2 BA, 1,415 SQ FT – $2997

Something to keep in mind when reviewing rental comps: Many of the above apartments offer move-in incentives due to low occupancy. Concessions such as 1st month free, no deposit, and other discounts.

Rental Activity – Chapman Commons, Garden Grove

ACTIVE – 2 BD / 2 BA, 1,117 SQ FT $2,250

LEASED – 2 BD / 2 BA, 1,060 SQ FT $2,100

LEASED – 2 BD 2 / BA, 1,120 SQ FT $2,400

ACTIVE – 3 BD / 2 BA 1,336 SQ FT $2,900

ACTIVE – 2 BD / 2 BA 1,547 SQ FT $2,500

LEASED – WORK/LIVE 1 BD / 1 BA 1,760 SQ FT – $2,600

ACTIVE – 1 BD / 1 BA 705 SQ FT $1,750

LEASED – 2 BD / 2 BA 1,095 SQ FT $2,195

LEASED – 2 BD / 2 BA 1,100 SQ FT $2,300

LEASED 2 BD / 2 BA 1,095 SQ FT $2,325

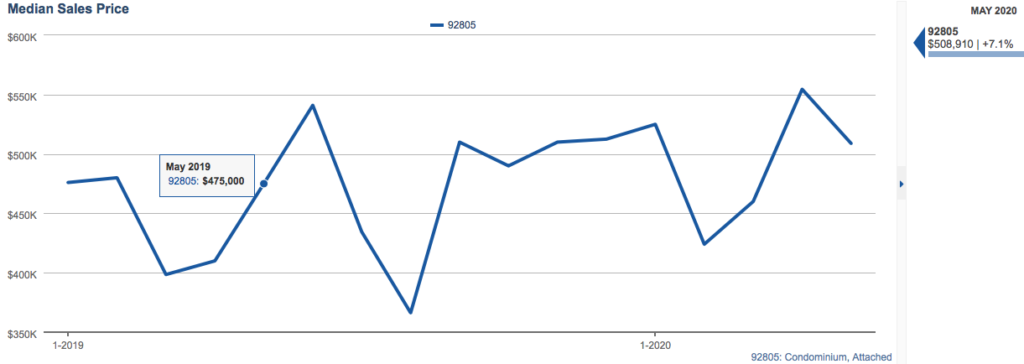

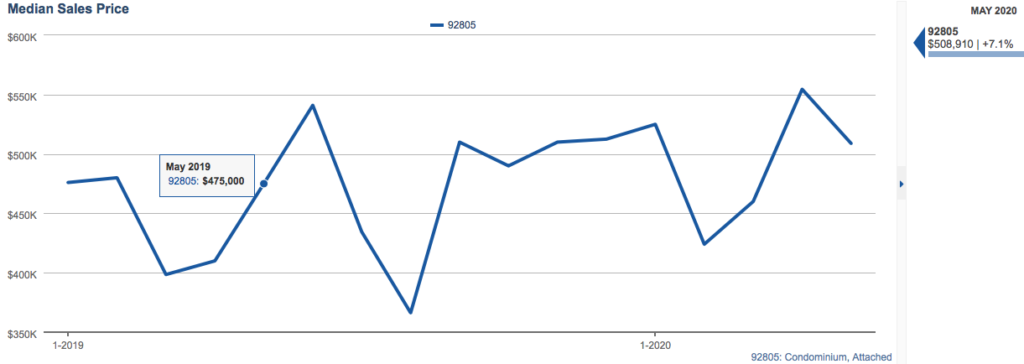

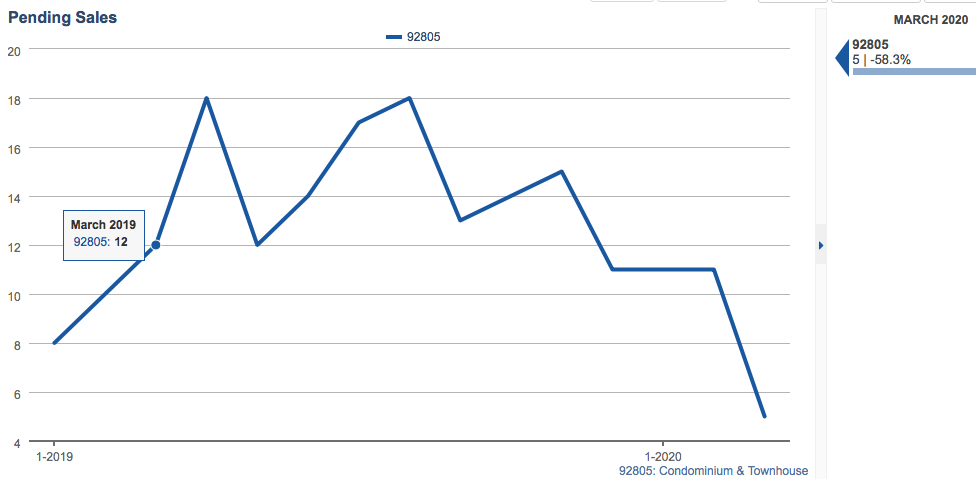

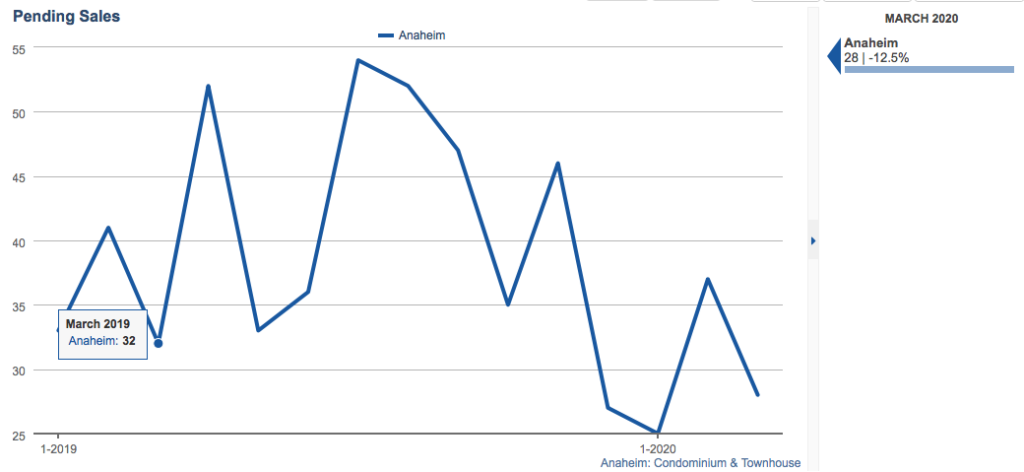

The April number for pending sales will be released in a few weeks. Meanwhile, the March numbers show the “pending” condos and townhomes in Anaheim 92805 which includes The Domain, Harbor Lofts, and Stadium Lofts have decreased significantly likely due to COVID-19:

As expected, the Coronavirus crisis has slowed down the market as sellers and buyers become concerned about safety and market conditions in general. However, homes and condos are still selling since the whole lockdown started.

The lockdown in all of California was ordered by Governor Newsom on 3/19/2020. Since Realtors have 3 days to update listing statuses, we’ll use 3/22/2020 as the start date of the quarantine when using market data. According to the CRMLS California Regional Multiple Listing Service, 65 properties have went into escrow in all of Anaheim since then. This doesn’t include homes that went into escrow and have closed since (which will bring the number even higher.)

Just thought I’d throw that out there to refute that myth “nobody is selling houses right now.”

View active listings for Chapman Commons, The Domain, Harbor Lofts, and Stadium Lofts here.

With the economic turmoil and many incomes affected from the Corona Virus, HUD Secretary Ben Carson announced a temporary foreclosure moratorium for homeowners with an FHA loan:

“Today’s actions will allow households who have an FHA-insured mortgage to meet the challenges of COVID-19 without fear of losing their homes, and help steady market concerns,” said HUD Secretary Ben Carson. “The health and safety of the American people is of the utmost importance to the Department, and the halting of all foreclosure actions and evictions for the next 60 days will provide homeowners with some peace of mind during these trying times.”

The full press release by HUD can be found here.

Unfortunately, this is only in effect for FHA loans. For this with other loans, I expect similar announcements from other secondary market investors such as VA, Fannie Mae and Freddie Mac.

All of the Government Sponsored Enterprises (known as “GSE’s”) have had FEMA programs already in place for Forbearance when an certain area is designated as a Federal Disaster area. It has yet to be determined if servicers will implement the forbearance program. In my experience, it’s been a case-by-case basis and it was implemented during the wildfires of 2018 in Orange and Riverside Counties.

Will this help homeowners?

Unfortunately, the only people this will help are people that have already been in the foreclosure process. It would halt proceedings. If your loan doesn’t belong to FHA, there hasn’t been a moratorium announced as of today I’m aware of.

For the foreclosure timeline, here’s a video I created back in 2009 or so. (disregard the website mentioned as I no longer have that domain)

In regards to Forbearance, it’s an option where a servicer will suspend payments for a certain amount of time while the principal balance increases. Here are the links on the Fannie Mae and Freddie Mac websites. FEMA must declare a federal disaster in their system for these programs to take effect. I know they’ve announced a “Federal Disaster” but we’ll see if that means all the applicable programs usually directed at local disasters apply. It’s worth asking about from your servicer.

In the end, eviction moratoriums for renters, foreclosure moratoriums, and forbearance programs only “kick the can down the road” and simply buys a homeowner or renter time. Even scarier, all the options mentioned can create a larger issue of a growing backlog of money owed. Negotiating these amounts are never guaranteed.