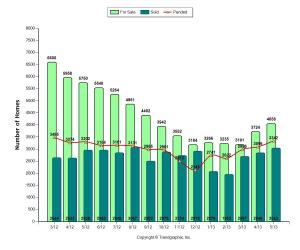

Although inventory seems to be on the rise in North Orange County, ask anyone buying a home and they’ll agree that it remains extremely tough out there.

Especially with the “cookie cutter” newly constructed home, double digit offers within the first few days are the norm even when sellers price their home 5% above the comps.

This has led to many high producing agents refusing to work with buyers altogether regardless of qualification or motivation. I’ve heard several of my peers tell stories of submitting over 10 offers on different homes and not getting their buyer the deal.

As an agent, the toughest price point to work with seems to be the conforming territory of $650,000 and under. Mainly saturated by first-time homebuyers and investors, this price range seems hopeless for many due to stiff competition from cash buyers, high downpayment offers, and unethical listing agents who simply wanted both sides of the commission.

Although it has been tough out there, I was able to have 3 of my offers accepted for buyers in the sub-$550,000 price range in the last month. While is this nothing to brag about, it still resulted in 3 clients finding a home that suited their needs. ALL of them were low-downpayment buyers with 2 of them using FHA financing. One of the buyers had their very first offer accepted while the others took 3 tries to finally have their homes under contract.

As an agent who’s accustomed to competing against multiple offers, I have to admit it’s part luck, part strategy.

Of course, we can’t control our luck. We can only use strategies that will increase your chances. I’ve been able to maintain a ratio of at least 3:1 when comparing offers submitted vs. accepted offers.

Here’s some of my tips:

- Expectations are everything. Sit down with an experienced agent before looking at homes. Meeting for 30 minutes can save you hundreds of dollars in gas and your precious time. A good agent will take your through the basics of what you can buy in this market and what price the other buyers are willing to pay. Most important, the agent can tell you if your goal is realistic or not.

- Make a lasting impression on the seller – when possible, introduce yourself to the seller when viewing their home. It’s happened on several occasions where the seller said something along the lines of, “We LOVE that young couple. We don’t want to sell to just anyone.” Of course, don’t overdo it. Just make sure you at least have them associate your name with a face. Don’t be afraid of saying, “Be on the lookout for our offer. Our names are _____ and _____. Your agent should be receiving it by tomorrow!”

- Highest isn’t always the best – a savvy listing agent knows if a home will appraise or not. Your agent needs to make sure that he/she shares the same opinion of appraised value. If offers start exceeding that amount, higher offers start becoming a non factor unless the buyer can remove their appraisal contingency or create an addendum promising to pay the difference up to a specified amount.

- Going direct to the listing agent rarely increases your chances of acceptance – especially for the high producing listing agent, they know that the buyer going direct to the listing agent rarely is willing to pay the most. They often ask for “kickbacks” and are unrealistic on price. On several occasions when I’m the listing agent, I’ve even had buyers offer me money on the side if I were to withhold other offers from the seller! In this market, a listing agent often has multiple buyers approaching them. Additionally, the high producing agent knows they must keep their reputation intact with the local broker community, so the last thing they want is to have their record blemished from not playing fair. I know there are many stories out there about a friend of relative getting a deal from a shady agent. Refer to tip #5.

- Know the listing agent’s dual agency % – your buyer’s agent can look up an agent’s past production in the MLS. If the listing agent has a past history of representing both sides more than 20% of the time, it’s likely something’s not right. If this is the case, have your agent either 1.) Present your offer in person, or 2.) Send your offer via certified mail directly to the seller. You can imagine how much explaining a shady agent would have to do if a seller received an offer in the mail and the agent withheld it.

- Don’t back down from showing challenges – in one of my offers accepted in the last month, there was a tenant that was flaky cooperating with showings. It took several calls and text messages to finally see the home. Each time I spoke to the listing agent, I made sure I was courteous and empathized with the situation. If that home allowed flexible showings, it would have had multiple offers competing against my buyer’s FHA offer.

The world is based on relationships! - Hire an agent with relationships in the broker community – I always like to use the nightclub analogy: if you don’t know the bouncer at the door or the owner, you have to get in line with the rest. In all 3 instances where I had my offers accepted, I either knew the listing agents personally or we’ve heard of each other and quickly established rapport. We aren’t talking about the “shady” agents that withhold higher offers in order to accept mine. A multiple offer situation usually ends up as a very close race with the top 2-3 offers with a huge drop off after that. Sometimes, any little edge can matter. The last thing you want is some schmuck as your buyer’s agent who works part time for some no-name company.

Happy hunting! Call me if you want a free consultation!