With rising land, construction and business costs, many builders are forced to build “patio homes” while backyards and parking are becoming a thing of the past.

Luckily for builders, the new generation of buyers (mostly asian — like me) have kept buying and have sent an implied message that “we don’t care about lot size — it’s about living space.“

I’m sure you can do an appraisal study and you’ll find the value of an extra 2,000 or so of lot square footage will be next to little value in many cases. Of course, this is assuming all other things are equal: view, backing a street (or not), next to entrance, etc.

Which brings the following questions: What should the balance be? At what point will buyers respond?

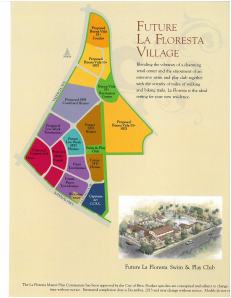

On December 3rd, residents who live in the surrounding area of the proposed development of the current “Shaner Farm” on the southeast corner of Morse and Kraemer met with representatives of HQT, an Orange County-based homebuilder. This was the 3rd of a series of meetings that began in early 2013.

HQT has several developments in Placentia: Founders Park, Alta Vista South, and Bradford Court. Like most homebuilders, lot spaces have shrunk over the years as the new generation of buyers seem to be unfazed by the lack of outdoor spaces. The latest community constructed by HQT in Placentia was Bradford Court, which consisted of detached condominiums up to 3 levels high.

As shown in the photo above, the homes did not include yard spaces in order to maximize the amount of units. However, plenty of curb parking seems sufficient in addition to the 2 car garages of each unit.

Since 2009, other new home communities have been constructed in Placentia and nearby Brea and Yorba Linda. Although I don’t have the details for the Blackstone project where backyards are present in most communities, I suspect that City Planning and Shea / Standard Pacific maintaining a reputation came into play over just “maximizing profit.”

Out of the homes recently built, Crescent Heights in Placentia seems to be the most similar in terms of land space, home sizes, and number of homes built.

Crescent Heights is a gated community with homes that were built in 2011. There are small backyards and an HOA pool for residents. Curb parking is allowed — where a car can fit.

In the initial stages of planning, HQT proposed a community that would consist of a combination of high density attached living and several single family homes for a total of 112 units. After feedback from surrounding homeowners and city officials, that number changed to 78 detached single family homes in a gated community. To maximize the number of homes, outdoor spaces will be limited to small spaces and no street parking will be allowed. At the northwest corner of the lot, a “linear park” will be built. The smallest floor plan will be 2,084 square feet with 3 bedrooms and 2-1/2 baths. The largest homes will be on the east-most section of the neighborhood and are expected to be near 3,000 square feet with an optional downstairs bedroom.

HQT feels that based on their experience in a past community where no curb parking was permitted, 20 non-assigned spaces should be adequate. Homeowners present at the meeting disagreed. They felt that based on the site plan shown above, it would be natural for the overflow to park on nearby Fairway Lane and use the parking lot of Margo’s Flowers on the southeast corner.

While using averages from several studies may show that 15 spaces will be adequate for a “normal” day, it’s obvious that 2 or more homes having guests over during the holidays or Superbowl would force cars to park nearby.

This arrangement of limited guest parking reminds me of a nearby community called “Rio Vista Walk” by Olson Homes in Anaheim built in 2003. Whenever I’d visit my relative that lives in that neighborhood, I’d occasionally have to park at the nearby elementary school parking lot.

From HQT’s standpoint, there’s a fine balance that has to be struck between maximizing a profit and maintaining a reputation as a company.

What’s in store for the future of building homes?