Any of this sound familiar?

The public and press calls it a “hot” market and the majority of buyers think it’s time to buy. Warren Buffet’s saying applies here. “Be fearful when others are greedy. Be greedy when others are fearful.”

Abnormally low rates create a false sense of affordability.

Home builders start or resume building – builders offering very low commissions to brokers (or no cooperation at all), camping out, new developments opening everywhere.

“Move up” sellers make up a significant portion of the market. Although I’ve said all along that a seller trading equity is better off moving in a “bad” market, most will move contrary to what makes sense financially. When you start seeing more listings “contingent upon seller finding replacement property” or sellers asking for a rentback, these are sellers who likely are moving up.

Sounds like we are in a peak market, right? While today’s market may seem this way, this doesn’t guarantee that there is a Real Estate “Bust” that will soon follow like a few years ago. Here are some major differences between 2013 and the “high times” of 2004-mid 2007:

- Loans require verification of income: while it’s true that an FHA loan can include countless co-signers that may never contribute a penny, it’s still a far cry from the “no doc” and stated income loans. Today’s lending industry is more “ratio driven,” where a borrower can only have a certain fraction of their income going toward their house payments and overall debts.

- Foreclosure alternatives – when a wave borrowers started missing payments in late 2007, there were only two choices: 1) Let the bank foreclose and 2) Reinstate your loan. Today, numerous options exist such as modification, refinance, forebearance, etc.

There were very few choices for a distressed homeowner in 2007. - 30 year loans – The most common loan product used today is the good old fashioned 30 year loan where the borrower pays both principal and interest. That payment amount remains the same during the entire life of the loan. Back during the high times, the riskiest loan product was an “option ARM” where the borrower can opt to make a 1% payment and the balance would grow. They were also known as “negative amortization” loans. With those loans, they were time bombs where the balance can only grow to a certain amount.

- The Real Estate industry employs specialists today – although the “part timers” who are often liabilities will be around regardless of market conditions, today’s market still has a higher ratio of full-time professionals compared to 2004-07 where just about anyone with no experience at can make a six-figure income in Real Estate or lending. Many of those who jumped on the bandwagon ended up buying properties based on their short term income. When the party stopped, their homes would be foreclosed.

- Long term demand from buyers – unlike the peak of a few years ago, today’s market has significantly more pent up demand from overseas investors, population growth, an improving economy, and buyers who have recovered from bankruptcy, foreclosure or a short sale.

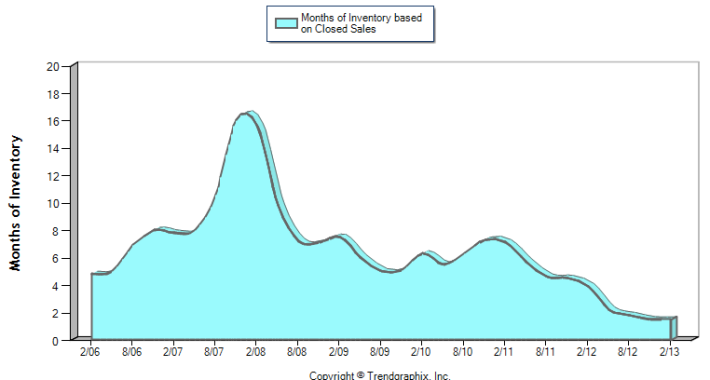

In late 2007, inventory skyrocketed. The next cycle will not be as drastic due to long term demand and foreclosure alternatives.

Yes, it’s true that the steeper the appreciation, the bigger the crash. Most agree that we will soon see an increase in inventory and a decline in values. However, just don’t expect the crash to be similar to mid-2007.