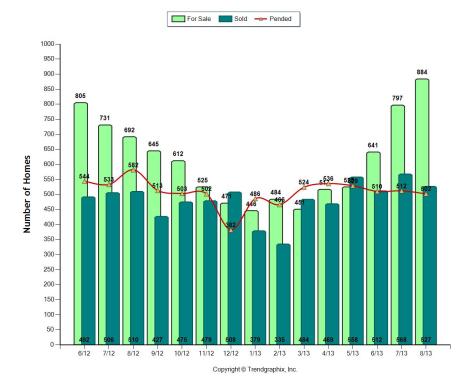

August numbers show the 5th consecutive month of increasing inventory. While it may seem like much more homes on the market when compared to March or April 2013, we are still in a very low 1.8 months of inventory.

To put things into perspective, we would need close to twice the amount of homes on the market for us to be in a “par” market, where the inventory is balanced between a seller’s and buyer’s market.

While public perception of the market will vary, there’s much more to supply and demand than labeling it a sellers, par, or buyer’s market. There are varying levels of each category and it can greatly affect the amount of showings your home attracts and eventually the proceeds from the sale.

Because of the increased inventory, adjustments need to be made on your selling strategy:

The table above assumes you don’t have a “niche” home. As said in another blog, different rules apply to niche homes.

Short Term Market Outlook

With rising interest rates and more homes for sale, expect values to be flat in the upcoming months. Expect appreciation to be gradual, single percentage point increases as opposed to skyrocketing conditions of early 2013. Many forget that even the historic surge of 2000 – 2005 had it’s lulls where the market would slow down only to pick back up in a few months.